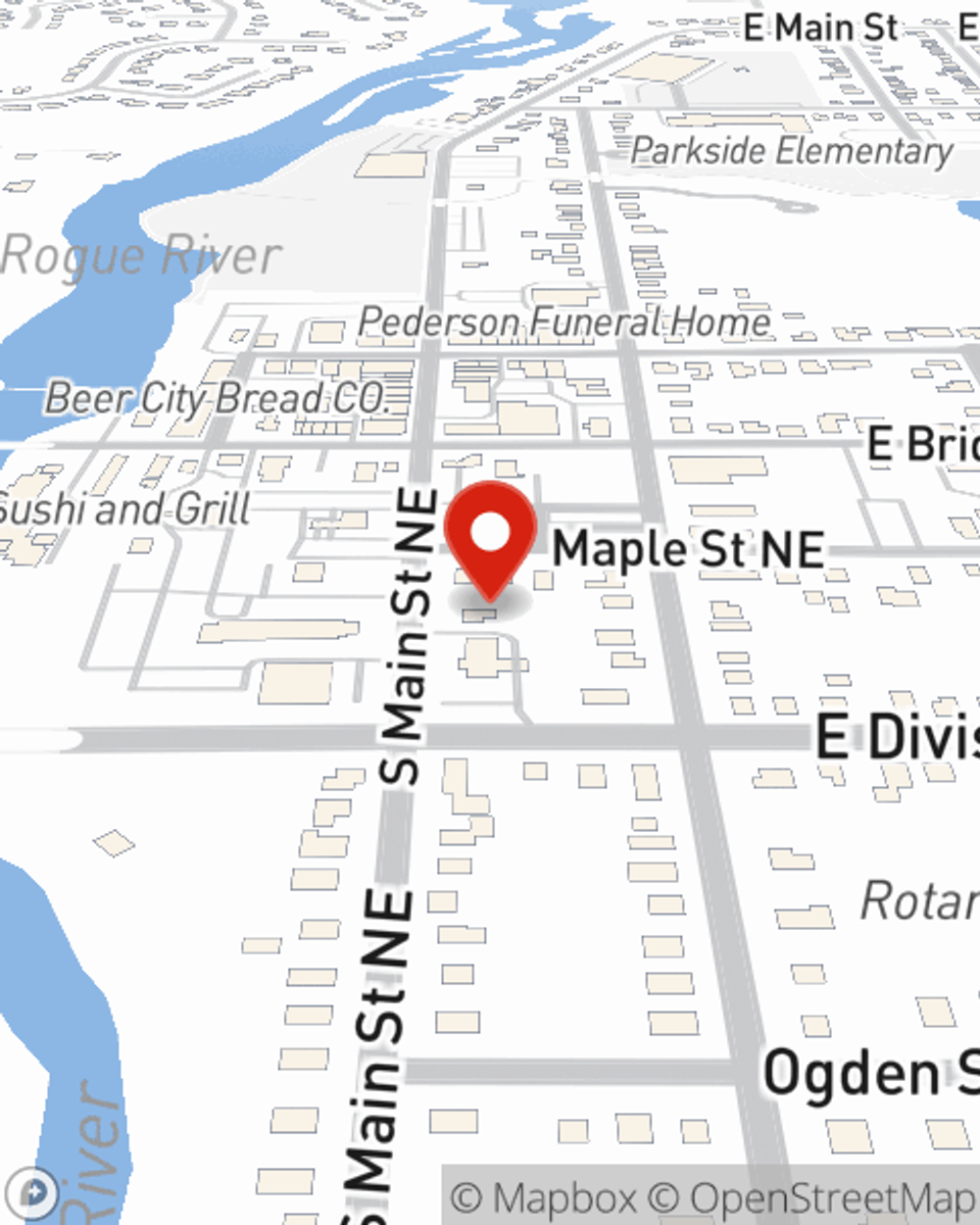

Renters Insurance in and around Rockford

Looking for renters insurance in Rockford?

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

- Rockford

- Cedar Springs

- Greenville

- Belding

- Kent County

- Ottawa County

- Montcalm county

- Mecosta County

- Muskegon County

- Newaygo County

- Oceana County

- Ionia County

- Allegan County

- Kalamazoo County

- Ingham County

Home Is Where Your Heart Is

No matter what you're considering as you rent a home - number of bathrooms, utilities, location, apartment or condo - getting the right insurance can be essential in the event of the unanticipated.

Looking for renters insurance in Rockford?

Renters insurance can help protect your belongings

Protect Your Home Sweet Rental Home

When the unpredicted vandalism happens to your rented apartment or home, often it affects your personal belongings, such as a coffee maker, a set of golf clubs or an entertainment system. That's where your renters insurance comes in. State Farm agent Rick Koryto is dedicated to help you evaluate your risks so that you can protect yourself from the unexpected.

It's always a good idea to be prepared. Call or email State Farm agent Rick Koryto for help getting started on coverage options for your rented home.

Have More Questions About Renters Insurance?

Call Rick at (616) 866-9561 or visit our FAQ page.

Simple Insights®

Do you need earthquake insurance if you don't live on the coast?

Do you need earthquake insurance if you don't live on the coast?

According to USGS, various U.S. locations have experienced earthquakes of magnitude four or more in recent years. Earthquake insurance can be valuable to all homeowners.

How to deal with noisy neighbors or issues

How to deal with noisy neighbors or issues

From noisy neighbors and arguments over property lines to adventurous pets, there are ways to successfully resolve disputes between neighbors.

Rick Koryto

State Farm® Insurance AgentSimple Insights®

Do you need earthquake insurance if you don't live on the coast?

Do you need earthquake insurance if you don't live on the coast?

According to USGS, various U.S. locations have experienced earthquakes of magnitude four or more in recent years. Earthquake insurance can be valuable to all homeowners.

How to deal with noisy neighbors or issues

How to deal with noisy neighbors or issues

From noisy neighbors and arguments over property lines to adventurous pets, there are ways to successfully resolve disputes between neighbors.